I recently commented on an article in Energy Risk Magazine entitled "Citadel builds physical gas trading business." However, I realized that I had missed the mark and that Citadel's move could possible inject some creativity into natural gas marketing. Despite what most people think, I believe that "all natural gas marketers are not created equal."

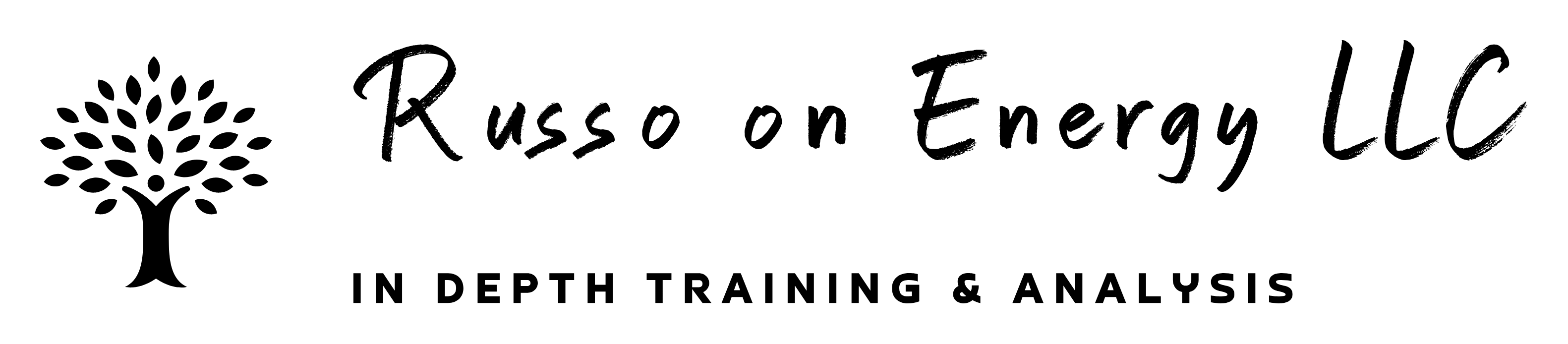

Right now natural gas prices are not volatile and in most cases trading below $2.00/MMBtu in most of North America.

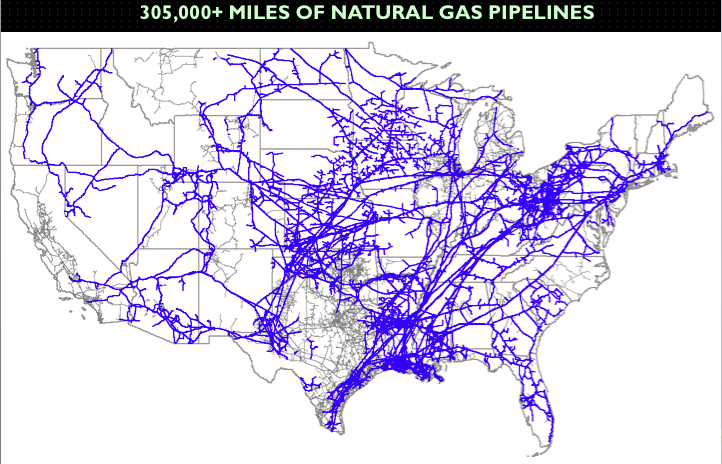

However, all it takes is a combination of pipeline and gas supply constraints and extreme weather events to create volatility and high natural gas prices. These effects raise electric power costs, especially in regions where natural gas fired generation is steadily growing and replacing coal-fired power plants. Keep in mind also that in regions where wind and solar power are growing, independent system operators (ISOs) and electric utilities rely heavily on natural gas-fired combustion turbines to quickly ramp up and down to balance their loads. Marketers like Citadel can play a critical role in helping the electric power sector deal with pipeline and other natural gas supply constraints that may arise in New England, New York, the Mid Atlantic and California provided they can offer a range of services to customers.

This doesn't necessarily mean that Citadel will be any different then most existing marketers. However, I do think that they bring a different philosophy to the table. Citadel prides itself on "entrepreneurial thinking and robust debate." They are also not burdened with the need to sell their production like some other marketers. I certainly don't question their expertise with energy derivatives, but doing physical gas deals is messy. Citadel's trading will also be scrutinized by the Federal Energy Regulatory Commission and the Commodity Futures Trading Commission. Hopefully Citadel will take a hard look at what new services power generators, electric and gas utilities, and industrial customers need. Customers not only need financial hedges, but also physical gas hedges to mitigate supply and purchase risks.

What Citadel and other marketers can provide their customers largely depends on what physical gas assets they have rights to or own, including firm pipeline transportation capacity in specific regions of the U.S. For example, many large natural gas marketers prefer targeting industrial companies and gas utilities under long-term contracts. Their goal is to sell most of their equity gas production in multi-year contracts or during bid week when 90% of next month gas is bought and sold. Very few marketers have the patience or desire to deal with merchant power generators in organized electricity markets like CAISO, ISONE, ISONY and PJM, who may need specialized services when natural gas prices spike or in short supply. The exception has been Engie (formerly GDF Suez Gas NA) that has provided physical natural gas call options or Take or Pay gas to power generators in ISO New England in recent years during winter months. That service was made possible by Engie's LNG Import Terminal in Everett, Massachusetts. Engie also provided firm transportation and guaranteed delivery of gas molecules the next day or intraday.

While gas and electricity coordination problems were largely in ISO-New England due to pipeline constraints, FERC did recognize that fuel security problems could occur in other areas in the future. FERC approved expanding the nomination window from 11:30 am Central Time to 1:00 pm Central Time for delivery of next day gas in North America. While not perfect, the additional time will help electric utilities and merchant generators schedule natural gas and align the gas day with how electricity markets are working.

In addition, the IntercontinentalExchange also offered Saturday only, Sunday only or Saturday and Sunday only gas instead of requiring purchasers to take weekend gas Saturday through Monday. While these actions offer greater flexibility in the daily natural gas markets to merchant power generators and other who wish to trade more spot gas given the relatively spot markets, more can and should be done. Marketers can play a prominent role.

The reason more services from natural gas marketers are needed is that the power sector will be using more gas as the Clean Power Plan is implemented. Up until now, natural gas pipeline constraints and gas facility accidents have been the exception, rather than the rule. However, that may be changing. For example, Southern California will have to do without 15 billion cubic feet of gas from the Aliso Gas Storage well due to gas leaks that have adversely affected the local community. The CA Public Utilities Commission, CAISO and others issued a joint report that indicated the gas shortages from Aliso may cause blackouts in Los Angeles this summer.

New England relies on natural gas for over 50% of its power generation. The region has faced pipeline constraints during winter when demands for gas for heating and power coincide. Several natural gas pipeline companies have worked to relieve those constraints have run into problems. Recently, Kinder Morgan suspended its New England Energy Direct pipeline project that would have brought Marcellus gas to Massachusetts. The reason, a sufficient number of shippers and purchasers would not commit to using the pipeline and paying for firm transportation capacity. More recently, the State of New York denied a section 401 permit for Williams' Constitution pipeline that also would have moved Marcellus gas from Pennsylvania via New York to Massachusetts. Any marketers that can address these gas supply problems will be welcome in the market place.

Disclosure: I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no positions in natural gas equities, physical natural gas or derivatives. Also I have no business relationship with any company or project that is mentioned in this article.